Apex Inc Issues a Bond of 1000

The companys line of business includes manufacturing miscellaneous structural metal work products such as metal plaster bases. Solution for If Apex Inc.

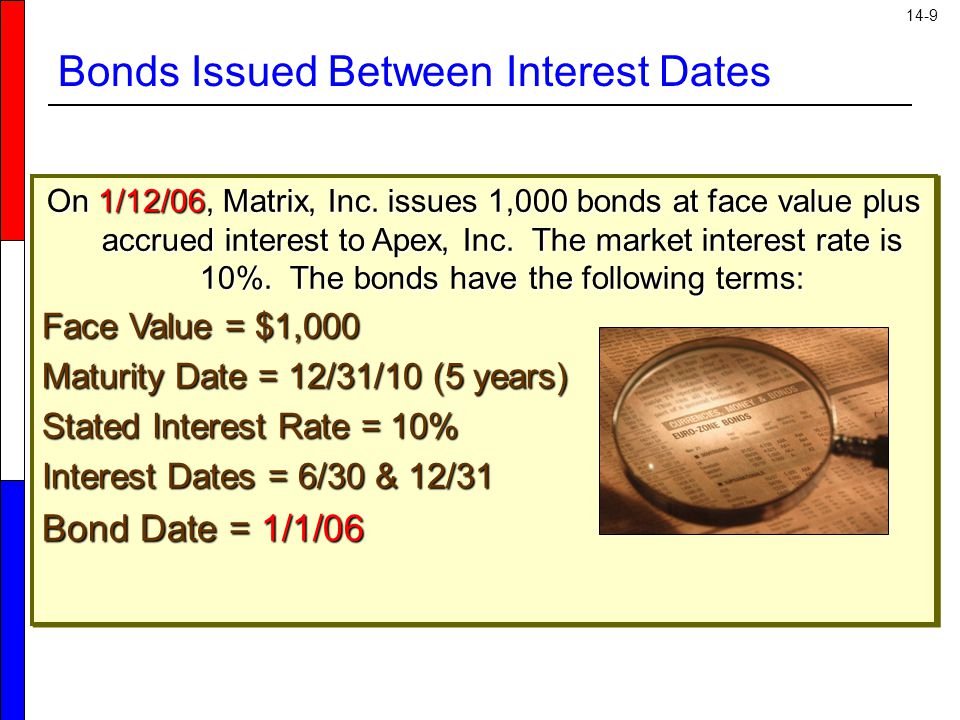

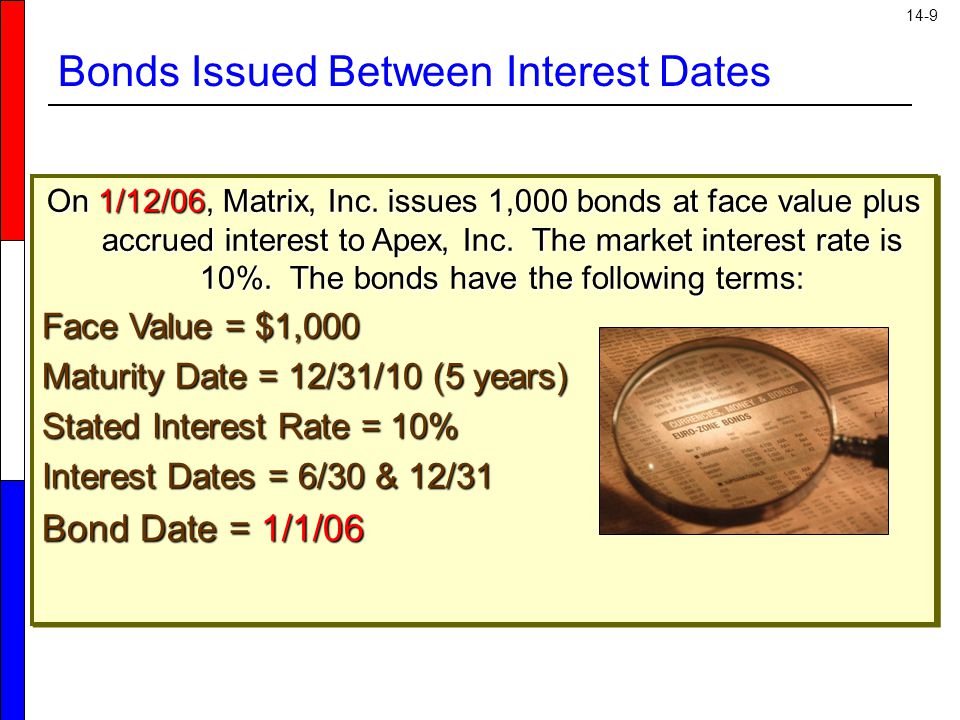

Bonds And Long Term Notes Ppt Download

To obtain copies of the bond forms or for questions regarding bonding of public infrastructure and structural SCMs please call Jean Weatherman Development Services.

. If you buy this bond hold it for the entire term and receive. Apex Legends 1000 Apex Coins - 1299 Apex Legends 2000 150 Bonus Apex Coins - 2599 Apex Legends 4000 350 Bonus Apex Coins - 5199. Issue Issuer Yield Prices Payments Analytical Comments Ratings.

These bonds typically pay out a semi-annual coupon. Company profile page for Apex Development Inc including stock price company news press releases executives board members and contact information. 2 The money market is a market that enables suppliers and demanders of long-term funds to make transactions which brings together suppliers and demanders of.

Moodys assigns Aaa to Apex NCs 295M GO Refunding Bonds Ser. Where should this bond be traded. The maturity of the bond is 30 years Where should this bond be traded.

The maturity of the bond is 15 years. Asia Pacific 65 6212 1000. The maturity of the bond is 15 years.

The maturity of the bond is 15 years. Issues a bond of 1000 which pays interest semiannually at a coupon interest rate of 8. Lets look at a basic example.

Apex Legends 10000 1500 Bonus Apex Coins Terms and Conditions Based on MSRP of 1000 Apex Coins bundle purchased separately. Apex Company is planning to issue zero coupon bonds that will mature at 1000 in 20 years. Issues a bond of 1000 which pays interest semiannually at a coupon interest rate of 8.

Issue Information International bonds AbbVie 36 14may2025 USD. Issues a bond of 1000 which pays interest semiannually at a coupon interest rate of 10. Has an ROE 10 percent equity multiplier 3 and profit margin of 5 percent what is the total asset turnover ratio.

Issues a bond of 1000 which pays interest semiannually at a coupon interest rate of 8. The outlook is changed to stable from negativeThe upgrade of Apexs CFR to B3 from Caa2 results from the companys recapitalization which is reducing balance sheet by. If your required rate of return on these bonds is 935 what are you willing to pay for the bonds.

The downgrade of Apexs CFR to Caa2 from Caa1 and change in outlook to negative from stable reflects Moodys view that Apexs debt capital structure is untenable. Outlook stable 07 Oct 2020 New York October 07 2020 -- Moodys Investors Service has. Apex Fabrication And Design Inc was founded in 2003.

Where should this bond be traded. The maturity of the bond is 15 years. Owning a 10 ten-year bond with a face value of 1000 would yield an additional 1000 in total interest through to.

Lets say a hypothetical zero coupon bond is issued today at a discount price of 743 with a face value of 1000 payable in 15 years. Question 26 Apex Ino issues a bond of 1000 which pays interest semiannually at a coupon interest rate of 8. Krugmans Economics for AP 2nd Edition David Anderson Margaret Ray.

If you buy a 10-year bond at the face value of 1000 with a fixed 5 coupon rate you will receive a total of 50 in interest payments 1000 x 05. Requires Apex Legends on.

Solved Question 26 Apex Ino Issues A Bond Of 1 000 Which Chegg Com

Apex Inc Issues A Bond Of 1000 Which Pays Interest Semiannually At A Coupon Course Hero

Apex Inc Issues A Bond Of 1000 Which Pays Interest Semiannually At A Coupon Course Hero

No comments for "Apex Inc Issues a Bond of 1000"

Post a Comment